The Buzz on Wyhy

The Buzz on Wyhy

Blog Article

9 Simple Techniques For Wyhy

Table of ContentsThe Main Principles Of Wyhy Little Known Facts About Wyhy.The Greatest Guide To WyhyOur Wyhy StatementsThe Facts About Wyhy Uncovered3 Simple Techniques For WyhyThe 3-Minute Rule for Wyhy

The shorter your car loan term is, the greater your regular monthly settlement may be, yet you may conserve cash on interest. https://www.anyflip.com/homepage/hzbth#About. The quantity of cash a watercraft loan provider is prepared to supply you depends on your and history, your income and the worth of your watercraft - wyoming federal credit union. If you require a large lending amount, some lending institutions might need that you fulfill greater earnings and credit scores score limitsContent Note: Intuit Credit scores Karma receives settlement from third-party marketers, however that doesn't influence our editors' opinions. Our third-party marketers don't examine, accept or recommend our editorial web content. Information concerning monetary items not provided on Credit score Karma is collected individually. Our material is accurate to the most effective of our understanding when posted.

The Only Guide for Wyhy

That's why we offer attributes like your Approval Chances and financial savings estimates. Obviously, the deals on our platform don't stand for all financial products available, yet our goal is to show you as lots of fantastic choices as we can. Boats can be much more pricey than a cars and truck, which means finance amounts can be greater and terms can be a lot longer.

The Best Strategy To Use For Wyhy

In many states, if you quit making repayments on your auto loan, the loan provider can reclaim it. With a secured watercraft car loan the watercraft acts as the collateral, which implies the lender may be able to take it back if you go right into default.

You might have extra choices in how you utilize an unsecured watercraft lending contrasted with a secured boat loan. If you choose not to obtain a personal financing, a home equity finance, which is a type of bank loan, can be another choice. This sort of finance would utilize your home as security for your boat financing.

You can normally request as much as a 20-year finance term for a secured boat funding, depending upon the loan quantity and loan provider. Unsafe watercraft finances which are personal finances often tend to come with shorter terms (usually no even more than 5 to 7 years). The longer your financing term, the more you'll pay in overall passion on the lending.

Wyhy - Truths

Some loan providers provide 0%-down fundings however remember that making a down payment can hedge against the watercraft's depreciation, or loss of value over time, and aid protect against a scenario where you owe a lot more on your boat lending than the watercraft deserves (wyoming credit union). A deposit may also lower your monthly settlement and minimize the total quantity of interest you pay on the watercraft finance

Since April 2023, some loan providers supply starting interest rate, or APRs, of concerning 7% to nearly 10% on safeguarded boat finances. However factors such as the boat kind and model year, your credit report, lending term use this link and finance quantity will certainly impact your rate. If you wish to request a boat financing, you have a series of loan provider alternatives some financial institutions, cooperative credit union and boat dealerships provide watercraft financings.

Getting The Wyhy To Work

Right here are some financial institutions and credit report unions that provide boat fundings. Truist, formerly SunTrust, uses unprotected aquatic finances. The financial institution's on the internet loaning department, LightStream, offers finances varying from $5,000 to $100,000, with regards to 24 to 144 months however the lender says you'll require superb credit rating for its most affordable prices.

Bank of the West uses finances for new and previously owned boats and individual boat. Navy Federal Credit Union uses lendings for new and previously owned boats and individual boat, with terms of up to 180 months.

Wyhy Fundamentals Explained

Some lenders will use a watercraft lending to debtors with subprime credit report, yet they might still require a deposit and reduced debt-to-income proportion. If you have lower credit rating scores, you'll most likely be used a higher passion price than if you have outstanding credit. When determining your boat budget, do not neglect to consider the prices beyond the month-to-month repayments for your watercraft financing.

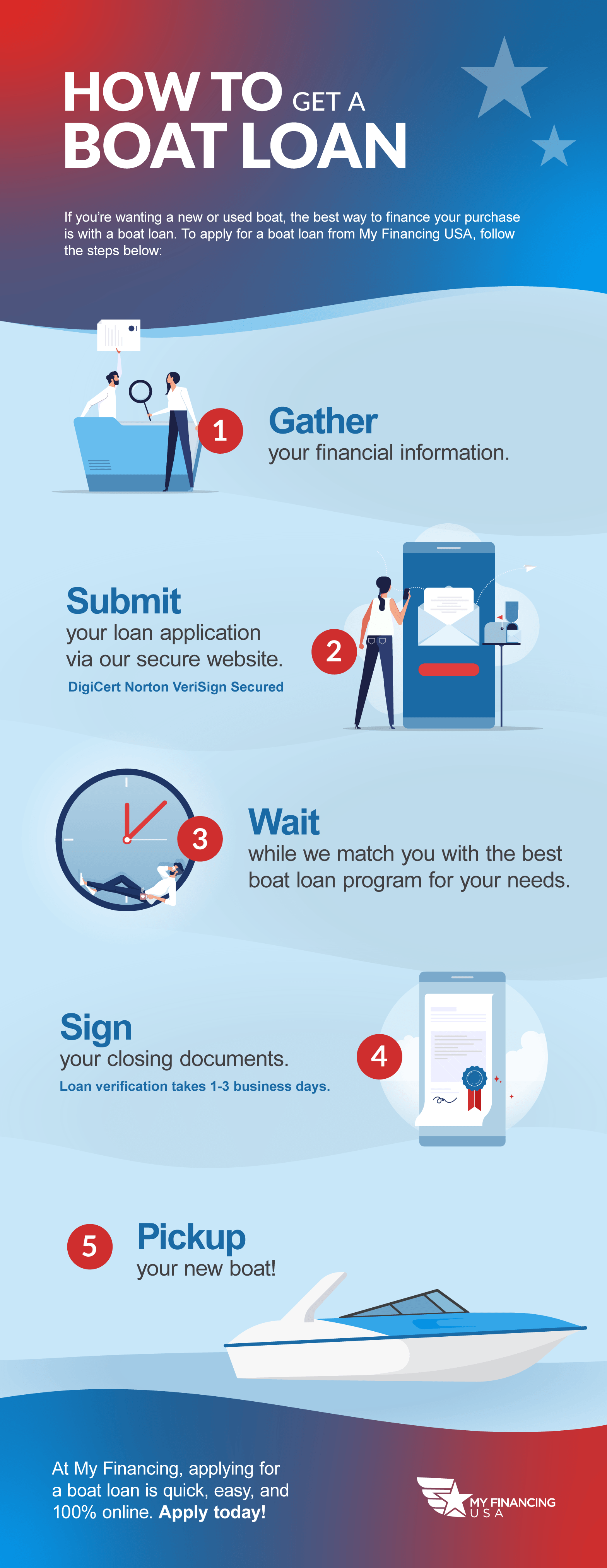

You'll wait for authorization, which might be available as quickly as the following company day, or might take a couple of company days, depending on the loan provider you're working with. Experienced boaters do everything possible to be prepared on the water so it's good to take the same approach with a boat loan.

Some Of Wyhy

Dana Dratch is an individual finance author (and coffee fanatic). She covers credit scores, cash and way of living problems (credit unions in cheyenne wyoming). Find out more.

Lenders typically make use of a debt-to-income proportion (DTI) to establish if someone would certainly get approved for a financing (https://pastebin.com/u/wyhy82003). That's since an applicant can have a healthy and balanced earnings but have a lot of financial debt, while another person may have a reduced earnings but a lot less financial obligation. It's usually the ratio that matters to a lending institution

Report this page